Working Capital for Marine Dealers

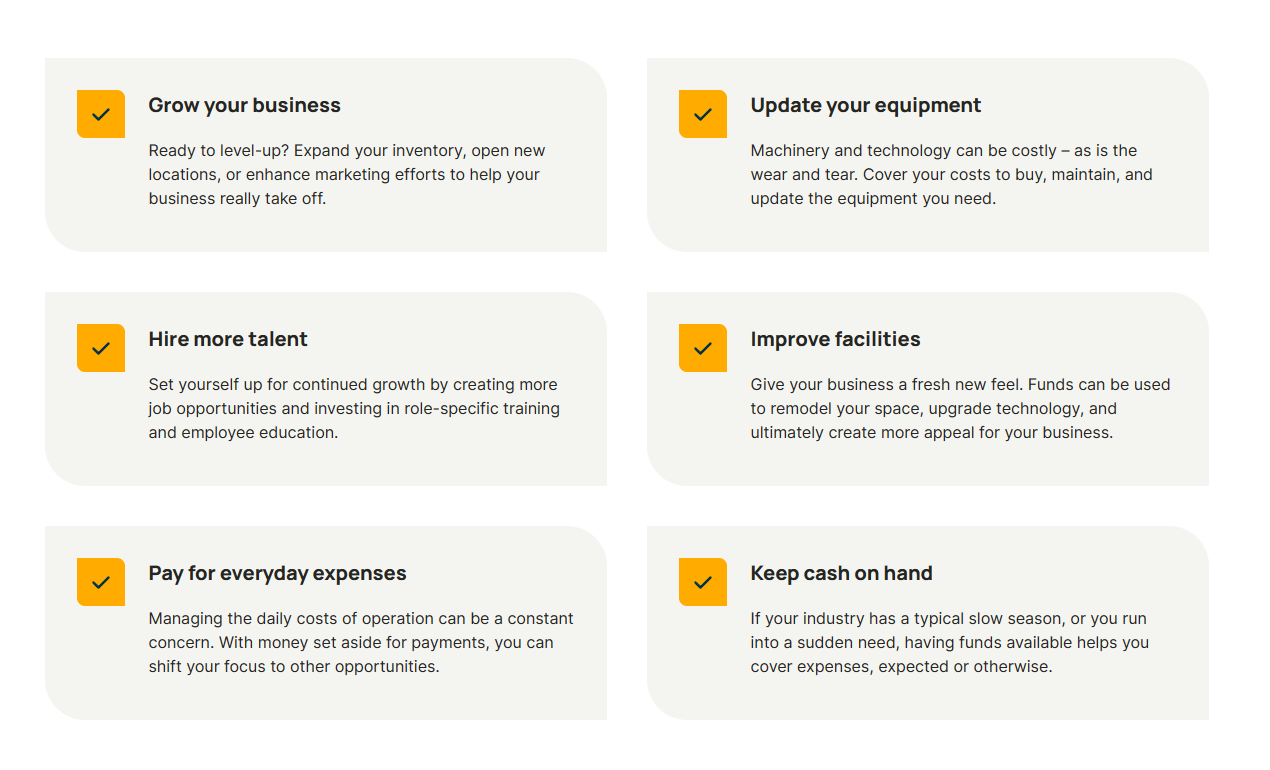

What Working Capital Is Used ForThere are a number of things which require having working capital on hand, and many of these are recurring business requirements. Some of these include paying your rent or other property expenses, normal business expenses, payroll for your employees, upgrading or repairing some of the equipment necessary for your business, and a whole host of unforeseen expenses. It’s also highly advantageous to have working capital on hand in the event that an unanticipated opportunity comes up which you can capitalize on for the benefit of your business. With no working capital available to you, such opportunities would come and go, and would completely pass you by.

Sources of Working CapitalThere are a surprising number of sources for working capital which your small business might take advantage of. First of all, you may be able to get approval for a loan from the Small Business Administration, either for a short-term or long-term loan. Then again, you may want to apply for a business line of credit, which works very much like a credit card, in that you can use some portion of it and repay it, thereby restoring your full credit balance. Other ways of acquiring working capital are made available by alternative lenders, using innovative financial products such as merchant cash advances, invoice factoring, or asset-based loans.

Obtaining the Working Capital Your Business NeedsObtaining the working capital that your business needs is not always an easy task, especially if you’ve been applying to banks for loans. If you’re ready to explore some alternative options, we’d like to hear from you. Contact us at Terrace Finance so we can discuss some ways to provide you with the working capital you need for growth, or simply to improve your cash flow. Call Bob Zinn 954-522-3773.

|